Pennsylvania

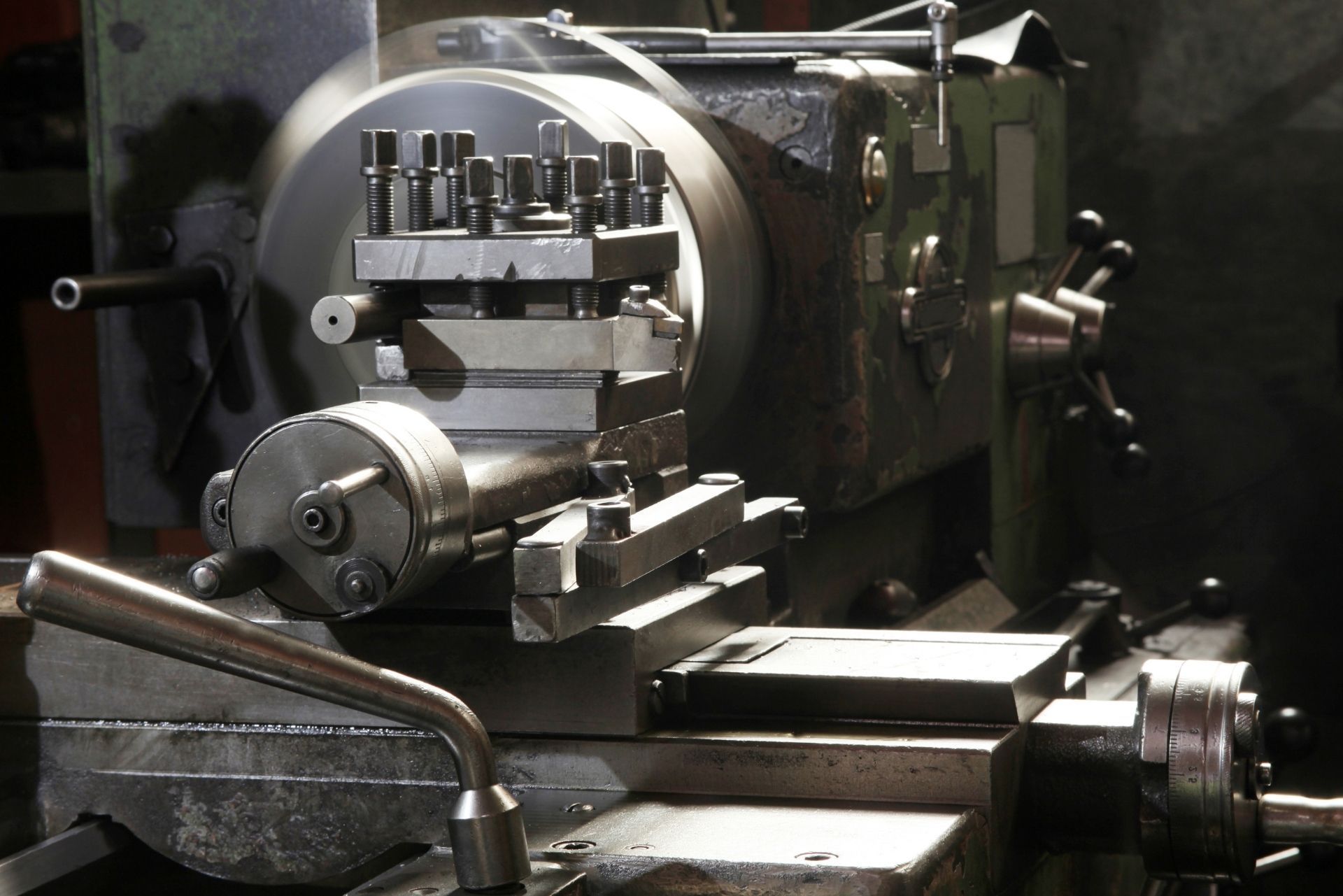

Machine Shop & Small Manufacturer Insurance

See How We're Different:

Call Us: 717-838-5464

A single jammed press or flying metal chip can shut down a Pennsylvania machine shop in an instant, and the injury risk behind those moments is higher in this state than most owners realize, with manufacturing workers here recording a total recordable case rate of 3.3 incidents per hundred full time employees in the year twenty twenty three, compared with a national rate of 2.4 for the same periodU.S. Bureau of Labor Statistics.

That kind of gap shows up in insurance costs, claim patterns, and even how underwriters look at a small fabrication shop compared with an office based business. Owners who treat insurance like a simple renewal task often find out the hard way that one serious injury or equipment fire can wipe out years of profit. With the right mix of policies, limits, and risk controls, the same business can turn insurance into a safety net that actually matches the hazards on the floor.

This guide breaks down how coverage works for Pennsylvania machine shops and small manufacturers, how state specific data shapes what you pay, and what practical steps help keep both premiums and surprises in check.

Why Pennsylvania Machine Shops Face Unique Insurance Risks

Pennsylvania has a deep manufacturing history, and that legacy still shows in the kinds of claims insurers see from small shops. Cutting fluids, welding operations, heavy lifts, and high speed spindles all sit a few feet from walkways and office doors. That tight mix of people, power, and property is why manufacturing, construction, and mining are described as the sectors where workers face the greatest dangerPond Lehocky Stern Giordano.

Injuries are not abstract statistics for this line of work. Recent statewide data shows that Pennsylvania manufacturers logged more than twenty thousand workplace injuries in a single year, the highest total of any industry group in the statePond Lehocky Stern Giordano. Behind those numbers are hands caught in equipment, back strains from material handling, slips near coolant covered areas, and hearing issues that emerge after years around loud tools. Each of those incidents can trigger medical bills, wage replacement claims, legal fees, or employee turnover costs that fall back on the business if coverage is thin or structured poorly.

Economic pressure adds another layer of exposure. State labor market reports show that Pennsylvania lost several thousand goods producing jobs in the year twenty twenty two, with durable goods manufacturing taking the largest hit inside that categoryPennsylvania Department of Labor & Industry. When shops run leaner crews to stay competitive, the same amount of work gets pushed through with fewer people, which often means longer shifts, faster setups, and less time for training or machine maintenance. From an insurer’s perspective, that combination raises both accident frequency and the chance that a single mistake will interrupt a critical operation.

By: Tyler Reitz

Managing Principal of Bowmans Insurance

Core Insurance Policies Every Small Manufacturer Should Consider

Machine shops and small manufacturers share the same broad categories of risk as other commercial operations, but the severity is often higher. A dropped part might just be scrap metal, yet a failed fixture can send a workpiece across the floor or into a wall. Insurance for these businesses needs to cover both ordinary slip and fall incidents and the worst case equipment losses that could shut down production for weeks. That is why many advisors talk about manufacturing insurance as a package designed to protect businesses in this sector against a range of interconnected risks, from liability to property to injured workersIgloo Insurance.

Most Pennsylvania machine shops end up with a mix of several essential policy types. Some can be bundled into a business owners policy, while others must be written separately because of the size of payroll, the level of inventory, or the types of equipment and contracts involved. Understanding what each coverage does makes it easier to see where gaps might exist and which add ons are worth paying for.

The list below highlights the lines of coverage that usually sit at the core of a solid insurance program for a machine shop or small manufacturer in the state.

- General liability insurance helps pay when the business is accused of causing bodily injury or property damage to others. Sources include visitors tripping over cords, coolant spills that reach a neighboring tenant, or a vendor injured while loading parts at a dock.

- Commercial property insurance protects the building you own, as well as contents such as machines, tools, raw materials, and finished goods. Fire, theft, some types of water damage, and certain weather events are typical covered causes, although details vary by policy.

- Business income or business interruption coverage replaces lost income if a covered property loss forces the shop to slow or stop operations. This coverage can be critical for small manufacturers that rely on a handful of large contracts or that cannot quickly outsource production.

- Workers compensation insurance pays for medical care and a portion of lost wages when employees are hurt or become ill because of their job duties. Pennsylvania requires this coverage for most businesses with employees, and for machine shops it is usually one of the largest premium line items.

- Commercial auto insurance applies to company vehicles used to move parts, deliver finished goods, or visit customer sites. Even a single pickup or box truck titled to the business generally needs its own commercial policy rather than relying on personal auto insurance.

- Equipment breakdown or boiler and machinery coverage responds to certain types of sudden and accidental mechanical or electrical failure, such as a compressor motor burnout or control panel short, not just external events like fire or wind.

- Product liability insurance addresses claims that allege a part or product you made failed and caused injury or damage downstream. For shops supplying components into larger assemblies, this risk can follow the part for years after it leaves your building.

Many Pennsylvania shops also consider cyber liability coverage, especially if they store customer drawings or proprietary specifications on networked systems. A ransomware attack that locks out those files might not spin a physical machine to a stop, yet it can halt production just as effectively.

Workers Compensation and Employee Safety in Pennsylvania

On the people side of the business, workers compensation sits at the center of any manufacturing insurance plan. In this state, injury rates in the sector are not only higher than the national average, they are also heavily concentrated in manufacturing compared with other industries. One recent report found that Pennsylvania’s manufacturing industry recorded more than twenty one thousand workplace injuries in the year twenty twenty three, the largest tally among all sectors in the statePond Lehocky Stern Giordano.

Federal data reinforces that picture. The same year, the state’s manufacturing sector registered a total recordable case incidence rate of 3.3 per hundred full time equivalent workers, outpacing the national manufacturing rate of 2.4 over that periodU.S. Bureau of Labor Statistics. For a small shop, that higher baseline risk shows up as steeper starting premiums, more scrutiny during audits, and a stronger expectation from carriers that owners will invest in safety training and formal procedures.

The way payroll is classified plays a major role in how those premiums are calculated. The Pennsylvania Compensation Rating Bureau has noted that a category it labels as “All Other Classes” accounts for a significant share of payroll in the state workers compensation market, at forty one percent according to its twenty twenty three state activity reportPennsylvania Compensation Rating Bureau. Many machine shop employees fall into a small set of specific manufacturing classifications, while support staff or salespeople may land in that broad catchall group. Keeping job descriptions accurate and separating clerical payroll from shop floor payroll can prevent the business from paying elevated manufacturing rates on work that rarely sees the inside of a bay.

For owners, strong workers compensation coverage is only half the equation. Insurers look favorably on shops that track near miss incidents, maintain lockout and tagout procedures, enforce personal protective equipment rules, and document safety meetings. Those steps reduce the chance of a claim, but they also support the defense of a claim if an injury does occur. Over time, a cleaner loss history can help offset the higher baseline risk that comes with operating in one of the state’s most injury prone sectors.

Coverage Comparison: How Key Policies Protect Your Shop

Coverage names often sound abstract until they are mapped to specific problems a shop might face. One effective way to sanity check an insurance program is to imagine different loss events, then see which policy would respond first and whether the limits on that policy feel adequate for the scale of your work. The table below offers a quick way to compare how several common coverages apply to the same kinds of events.

This is not a full list of every possible policy, and it does not replace a detailed review of forms and endorsements. It does, however, give owners and managers a framework for asking better questions when they sit down with their broker or carrier representative.

| Coverage type | What it mainly protects | Typical machine shop scenarios |

|---|---|---|

| General liability | Claims from third parties for bodily injury or property damage | A delivery driver slips on an oily patch at your dock and breaks an ankle, or a customer claims your employee scratched their vehicle while loading parts |

| Commercial property | Buildings, machinery, tools, inventory, and office contents | An electrical short starts a fire that damages a machining center and stored raw bar stock, or thieves steal portable tools from a locked tool room |

| Business income | Lost net income and some ongoing expenses after a covered property loss | Smoke damage forces you to shut down production while walls, ceilings, and machines are cleaned, and customer shipments are delayed |

| Workers compensation | Employee medical costs and wage replacement for work related injuries or illness | An operator suffers a hand injury at a press brake, or a material handler hurts their back moving heavy fixtures |

| Equipment breakdown | Sudden and accidental equipment failures not caused by external events | A critical air compressor motor burns out or a CNC control board fails due to an internal electrical arc, halting several machines that depend on it |

| Product liability | Allegations that your product was defective and caused harm | A customer claims a machined component you supplied cracked in service, leading to a larger assembly failure that damaged their equipment |

Looking across the table, it becomes clear that most real world problems trigger more than one policy. A fire might bring in commercial property, business income, and even workers compensation if an employee is hurt while evacuating. That is why aligning limits, deductibles, and waiting periods across policies is just as important as choosing which coverages to buy in the first place.

Managing Insurance Costs Without Cutting Protection

Every machine shop owner feels the pinch of insurance premiums, especially when carriers push for rate increases year after year. A study conducted in Pennsylvania found that a large share of small businesses offering health insurance saw their costs rise sharply over a five year stretch, with many reporting annual increases in the range of ten to twenty percentCenter for Rural Pennsylvania. Even though that study focused on health benefits, it reflects a broader pattern that business owners recognize across many types of coverage.

There are signs that regulators keep an active eye on pricing, at least in some lines. For example, in the first half of the year twenty twenty five the Pennsylvania Insurance Department reportedly blocked more than two hundred million dollars in requested annual property and casualty premium increases, including over one hundred million tied to title insurance aloneThe Legal Description. While title insurance is a different slice of the market than machine shop policies, this move signals that state regulators are willing to scrutinize carrier filings and push back when proposed hikes look excessive.

For shop owners, the most practical way to manage costs is not to hunt for the rock bottom premium, but to dig into how that premium is built. Payroll classifications, sales by product line, use of subcontractors, and the condition of buildings and equipment all feed into the pricing model. Keeping safety programs active, maintaining written procedures, and documenting training can support arguments for better rates. So can accurate job coding that separates office staff from shop floor roles, or distinguishes between high hazard and lighter duty manufacturing tasks.

Another lever is the structure of deductibles and self insured retentions. Accepting a modestly higher property deductible can trim premiums, as long as the business keeps enough cash reserves to handle that upfront cost when a loss hits. On the liability side, adding risk management tools such as vendor agreements, quality control documentation, and strong contracts can reduce the chance that a dispute escalates into a full blown claim, which also keeps loss history cleaner over time.

Practical Claim Scenarios for Machine Shops and Small Manufacturers

Insurance becomes much easier to evaluate when owners think through specific scenarios that might actually occur on their floor. Instead of asking whether they have general liability or property coverage, the more useful question is what would happen if a high value machine went down, a key employee were injured, or a finished part failed at a customer site. Each scenario touches different policies, and often reveals either a coverage gap or a need to raise certain limits.

Consider a fire that starts in a dust collection system connected to several pieces of equipment. Flames and smoke could hurt machines, material, and the building itself. Property insurance would respond to the physical damage, while business income coverage would help replace lost revenue while repairs are made. If investigators found that improper housekeeping or missed maintenance contributed to the event, the insurer might still pay, but the loss could influence future pricing and deductibles.

Now imagine a cutting tool breaks, sending a fragment into an operator’s eye, even though that employee was wearing safety glasses. Workers compensation would handle medical costs and wage replacement, while risk control consultants from the carrier might review whether shields, machine guarding, or additional face protection would have prevented or reduced the injury. If the tool manufacturer were alleged to have produced a defective product, subrogation efforts might follow as the workers compensation carrier seeks to recover some of what it paid.

Another scenario involves product liability. A shop machines components that end up in agricultural machinery. Months after delivery, a customer claims that a part cracked in service, causing a breakdown that damaged other equipment and ruined a harvest. The customer’s insurer may pursue your business to recoup its own loss payments. Product liability coverage, often packaged with general liability, would typically fund the legal defense and any covered settlement or judgment, as long as the alleged failure falls within the policy terms.

How Much Insurance Do Pennsylvania Machine Shops Need?

There is no single right answer for how much coverage a machine shop should carry. The proper limit depends on the value of buildings and equipment, the complexity and end use of the parts produced, the presence of hazardous materials, and the financial strength of the customer base. A small prototype shop taking on low volume, non critical work has a very different risk profile than a fabricator supplying parts into medical devices or transportation systems.

Property limits should reflect the realistic cost to repair or replace your building and key machines, not what you originally paid for them. Replacement values often rise faster than expected, especially for specialized imported equipment or custom setups that require long lead times. Business income coverage should be set high enough, and for a long enough recovery period, to account for how long it would actually take to resume normal operations after a major loss, including lead times for new machinery and the time needed to win back customer confidence.

On the liability side, many small manufacturers opt for a combination of underlying general liability and an umbrella or excess liability policy. The right level depends on contract requirements, the potential severity of a product failure, and the likelihood that customers could be injured or large property losses could occur because of something that left your facility. Even if contracts do not demand higher limits, owners often choose to buy more protection than the bare minimum, because legal defense costs alone can quickly absorb a standard policy limit in a complex case.

Frequently Asked Questions about Pennsylvania Machine Shop Insurance

Shop owners and plant managers often ask similar questions when they start building or reviewing an insurance program. The answers below cover some of the most common concerns in practical, plain language.

Is workers compensation insurance really mandatory for small machine shops in Pennsylvania?

In most cases, yes. State law generally requires employers with at least one employee to carry workers compensation coverage, and inspectors can impose penalties if they discover uninsured employees on a shop floor. Even beyond the legal requirement, injury rates in Pennsylvania manufacturing are high enough that self insuring this risk is rarely realistic for a small business.

Do I need separate product liability insurance if I already have general liability coverage?

Many general liability policies include product and completed operations coverage, but the scope and limits can vary. If your parts end up in critical systems, or if you are building to customer specifications with tight tolerances, it is smart to review the product liability language and consider dedicated or expanded coverage so that a single failure does not overwhelm your limits.

How does my safety program affect insurance premiums?

Carriers look closely at safety culture when pricing manufacturing risks. Written procedures, documented training, consistent use of personal protective equipment, and housekeeping habits all influence how underwriters view your operation, which can help secure better rates or access to more competitive markets over time.

What information will insurers ask for when quoting coverage?

Expect to provide details about payroll by job type, annual sales, main products and customers, key equipment, building construction and protection features, and any recent claims. Photos of the facility, copies of safety manuals, and sample contracts with customers or vendors can also help paint a clearer picture of your risk.

Can I reduce my premium by raising deductibles on property and liability policies?

Often you can, but it is important to make sure the business can comfortably handle those higher out of pocket costs when a loss occurs. A deductible that looks attractive on paper can become a cash flow strain if several smaller claims hit in the same year.

Do home based machine shops need commercial insurance?

Yes. Homeowners policies usually exclude or severely limit coverage for business related equipment, inventory, and liability. Even a small machine or fabrication setup run from a garage or outbuilding typically needs its own business policies to be properly protected.

Key Takeaways for Pennsylvania Shop Owners

Machine shops and small manufacturers in Pennsylvania sit at the intersection of elevated workplace injury risk, heavy reliance on specialized equipment, and growing scrutiny from both customers and regulators. Injury data and sector specific reports make it clear that manufacturing remains among the most hazardous lines of work in the state, which explains why insurers and attorneys pay close attention to this segment of the marketU.S. Bureau of Labor Statistics. A thoughtful insurance program is one of the few tools owners control that can turn those external pressures into manageable business risks rather than existential threats.

The most resilient shops treat insurance as part of a broader risk management plan, not just an annual bill to be minimized. They invest in training and safety, keep classification and payroll data accurate, and take time to understand how each policy would respond in real scenarios, from equipment failures to product disputes. They also recognize that manufacturing insurance exists specifically to protect businesses in this sector from the unique mix of operational, legal, and financial risks they face every day, and they work with advisors who understand those nuances in the Pennsylvania contextIgloo Insurance.

With that mindset, machine shop and small manufacturing owners can move beyond worry about a single accident or contract dispute ruining their business, and focus instead on growth, quality, and the skilled work that sets their operations apart.

ABOUT THE AUTHOR:

TYLER REITZ, CIC, CPCU, ARM, AU

As Managing Principal of Bowmans Insurance, I’m passionate about helping businesses and individuals protect what matters most with clarity and confidence. With advanced designations including CIC, CPCU, ARM, and AU, I bring a comprehensive approach to risk management—ensuring every client receives strategic, reliable, and personalized coverage.

Contact Us

Why Work With Us?

Why Choose Bowman Insurance Group for Personal Insurance?

Choice and Transparency

Bowman Insurance Group works for you, not the insurance providers. We offer a wide selection of policies from reputable insurers, giving you options that suit your unique needs. We prioritize clarity and honesty, ensuring you understand each policy’s benefits and limitations.

Your Personal Advocate

Our team is committed to more than policy sales—we’re here to serve as your advocate. We balance your coverage needs with affordability, working to provide you with the best value without compromise. Every decision we support is made with your best interests in mind.

Expert Guidance for Life

Insurance can feel complex, but we’re here to make it simple. With years of experience, our advisors explain policies clearly and keep you informed of relevant changes. You’ll receive consistent support from trusted professionals who understand your needs and are dedicated to helping you make informed choices.

About Bowman's Insurance Group

Over 100 years Delivering Exceptional Service to Our Community

Personal Insurance Coverage in Pennsylvania

Personal Insurance Solutions in Pennsylvania

Home

Insurance

Auto

Insurance

Umbrella

Insurance

Condo

Insurance

Boat

Insurance

Motorcycle Insurance

RV

Insurance

ATV

Insurance

Insurance Client Reviews

Read our

customer reviews

40+

Insurance Partners

98%

Client Retention Rate

100

Years in Business

98%

Satisfaction Rate

Process of Working With A Personal Insurance Agent in Pennsylvania

Step 1: Initial Assessment

Our process begins with a comprehensive review of your personal insurance needs. We’ll assess factors like your lifestyle, family needs, and assets, so you get the coverage that best suits your unique situation.

Step 2: Customized Consultation

Meet with our knowledgeable agents one-on-one to discuss options tailored to your requirements. We aim to clarify your choices and recommend the most suitable coverage, considering both quality and affordability.

Step 3: Policy Selection & Activation

Once we identify the right coverage, we’ll handle the paperwork and activate your policy. Our team ensures a smooth, straightforward process, giving you confidence and peace of mind in your coverage.

Our Experts

Meet Our Team of Professional Insurance Experts

Tyler Reitz CIC, CPCU, ARM, AU

President

Carmen Donachy, CISR

Treasurer and Customer Service Rep

Brian Brassell, CSA, CRPC

Investment Advisor Representative, Director of Financial Services Division

Kassie Swope, CIC, CISR, AINS

Commercial Department Manager

Our News & Blogs